Fed rate hike won't have a positive impact on bitcoin price, here's why

While many analysts are predicting that an interest rate hike by the federal reserves will lead to a positive movement in the price of Bitcoin, one of the leading billionaire investors disagrees with this opinion.

Market speculations were met as the Fed announced a 25 pts interest rate hike, pushing Bitcoin higher. The cryptocurrency has been hinting at a bullish price move for the week since today's Federal Open Market Committee ( FOMC ) meeting ended

At the time of writing, Bitcoin is trading at $41,300 with a 5% gain on the last day. The price of BTC was able to break above this mark after a short period of volatility when Fed Chairman Jerome Powell began to intervene.

Bitcoin will continue to trade between $30,000 and $50,000.

Michael Novogratz, CEO of Galaxy Digital Holdings Ltd., in a recent interview ruled out any chance of bitcoin breaking its record this year. The flagship digital asset is likely to trade in the $30,000 to $50,000 range over the course of this year, he said.

Novogratz noted that despite the Fed's interest rate hike, it's unlikely that investors will be willing to invest the amount of liquidity they've poured into the space during the pandemic, which helped Bitcoin reach new highs.

As the Fed considers market tightening in its efforts to tackle inflation, investors are also assessing risks, he said. This means that the probability of injecting money into bitcoin this year is lower.

According to him “Bitcoin is a narrative story. It brings people together in a community. It's not that easy to attract newcomers when their houses are on fire

He continued that the ongoing war in Ukraine will also influence the choice of investors.

Bitcoin is traded in a pressure range

The ongoing war has brought the stock and cryptocurrency markets into a series of unpredictable movements. The price of Bitcoin reacted positively in the first days of this war, as it was believed that Russian oligarchs could use the asset class to evade sanctions.

This has led analysts watching the market to conclude that long-term holders continue to buy BTC whenever the price drops, but short-term investors sell as soon as there is a rally in an attempt to recoup what they have invested.

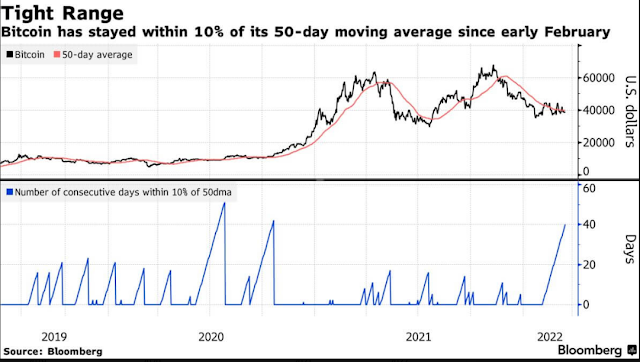

In fact, this has led to a narrow trading range over the past couple of weeks.

Is Novogratz right

The CEO of Galaxy Digital Holdings appears to be the only pro-crypto analyst who believes that the Fed's rate hike will not have a positive impact on Bitcoin.

According to a recent CryptoSlate report, Elon Musk and Michael Saylor advised their followers to hedge against rising inflation by owning assets like bitcoin and physical things like real estate or stocks of reputable companies.

Apart from these two, the previous CryptoSlate report also stated that “Bitcoin’s value has been deflationary” over the past decade, while “the country’s consumer price index (CPI) has been inflationary” over the same timeframe.

Essentially, this shows that investors are more likely to turn to Bitcoin as a hedge against rising inflation, as they believe the asset will rise in the long term.

إرسال تعليق